Sample Business Contracts

Canada-BC-Vancouver-6452 Main Street Rental Agreement - 657333 BC Ltd. and Good Morning

Free Customizable Lease Forms

- Commercial Lease. Start a state-specific lease for the rental of commercial property. Specify the term and rent due, as well as whether the landlord or tenant is responsible for property taxes, insurance, and maintenance and repairs.

- Commercial Sublease. When a tenant vacates commercial property before the lease term has expired, it may be able to rent the premises to a third party. The tenant would be the sublessor and the third party would be the sublessee. Besides preparing a sublease, both parties will want to review the provisions for assignment or subletting in the original lease agreement between the landlord and the sublessor.

- Sublease Agreement. Tenants of residential property should prepare a sublease agreement if they are seeking to sublease a room or the entire apartment or house to a third party. All parties should review the original lease agreement to see if there are any restrictions on subletting or assigning the premises.

- Triple Net Lease. Triple net leases are a type of commercial leases where the tenant has to pay for property taxes, insurance, utilities, and maintenance, in addition to the monthly rent.

- Office Space Lease. When renting an office space, tenants should understand the amount of the rent and duration of the lease. Other important terms include whether the space can be subleased, which parties are responsible for maintenance, and whether any furniture and furnishings will be provided.

Sponsored Links

RENTAL AGREEMENT

between

657333 B.C. LTD

- and -

GOOD MORNING

February 21st, 2003

657333 B.C. LTD

RENTAL AGREEMENT

THIS AGREEMENT made as of the 21st day of FEBRUARY, 2003

| BETWEEN |

657333 B.C. LTD, a company with a principal office at #804 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, Canada |

| ("657333 B.C. LTD") | |

| AND | Good Morning, a company with a principal office at 6452 Main Street, Vancouver, British Columbia V5W 1W2. |

| ("Merchant") |

WHEREAS:

| (A) | Merchant is the [lessor] of certain lands and premises located at 6452 Main Street, Vancouver, B.C. V5W1W2 (the "Premises"); |

| (B) | Merchant operates a retail business on the Premises; |

| (C) | 657333 B.C. LTD is in the business of renting, installing and operating automatic teller machines in retail business premises; and |

| (D) | Merchant desires to rent out a portion of the Premises to 657333 B.C. LTD in order that 657333 B.C. LTD may install and operate one or more automatic teller machines (the "ATM") at the Premises; |

NOW THEREFORE, in consideration for the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows.

PART 1

INTERPRETATION

Definitions

1.01 In this Agreement, including the recitals, except as otherwise expressly provided or unless the context otherwise requires:

Adjunct Charge means the fees charged by a Host System to 657333 B.C. LTD for an Unsuccessful Transaction;

ATM Owner means 657333 B.C. LTD unless 657333 B.C. LTD has transferred title to the ATM to a purchaser of the ATM, in which case, ATM Owner will mean such purchaser;

2

ATM Products means the ATM, the computer software, incorporating both object code and source code, that creates the on-line processing link and interface enabling ATM Transactions to be processed, and associated documentation and user manuals related thereto;

ATM Transaction means a function that is processed through the ATM, including without limitation cash withdrawals, deposits, transfers or other settlements, and balance inquiries effected through the use of the ATM;

ATM User means a Person that performs an ATM Transaction;

Force Majeure means any delay or failure by a party hereto to perform its obligations as required by this Agreement to the extent that such delay or failure to perform is caused by a reason or circumstance beyond such party's control, including, without limitation, acts or omissions of the other party, third party nonperformance, and failure or malfunction of computer or telecommunications hardware, equipment or software, provided that such party could not have foreseen the specific reason or circumstance which caused the delay or failure at the time of the conclusion of this Agreement or could not reasonably have been expected to have avoided or overcome it or its consequences;

Host System means a centralized computer processing system accessed through Cash One, or a processor used by Cash One, that provides electronic funds transfer and data processing services necessary to operate the ATM;

Successful Transaction means an ATM Transaction that is processed by the Host System and the ATM user's bank.

Surcharge Fee means the fees received for a Successful Transaction by 657333 B.C. LTD from an ATM User's account, net of all payments made to Host Systems and banks;

Unsuccessful Transaction means an ATM Transaction that is not processed by the Host System or the ATM user's bank.

Interpretation

1.02 Headings of the Articles and Sections hereof are inserted for the convenience of reference only and shall not affect the construction or interpretation of this Agreement.

1.03 Words importing the singular number include the plural and vice versa and words importing gender include the masculine, feminine and neuter gender.

1.04 This Agreement is made pursuant to the laws of the Province of British Columbia and shall be construed, interpreted and enforced in accordance therewith.

1.05 If any of the provisions contained in this Agreement is invalid, illegal or unenforceable in any respect, the validity, legality or enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby.

1.06 Subject to as hereinafter provided, this Agreement constitutes the entire agreement between the parties hereto pertaining to the subject matter hereof and supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written, of the parties and there are no other agreements between the parties in connection with the subject matter hereof except as specifically set forth herein.

3

PART 2

PROJECT DEFINITION AND COMPENSATION

Rental of Space

2.01 657333 B.C. LTD hereby agrees to rent from Merchant, and Merchant agrees to rent to 657333 B.C. LTD a certain area (the "ATM Rental Space") of the Premises as outlined in bold in Schedule A.

Rental Fees

2.02 During the term of this Agreement and as long as the ATM Rental Space continues to be made available for use by Cash One, 657333 B.C. LTD will pay Merchant an amount (the "Rental Fee") as set out in Schedule B.

Cash Loading Services

2.03 657333 B.C. LTD is responsible for ensuring that the ATM is periodically loaded with sufficient inventory and appropriate denominations of cash to meet the needs of ATM Users

Processing and Maintenance

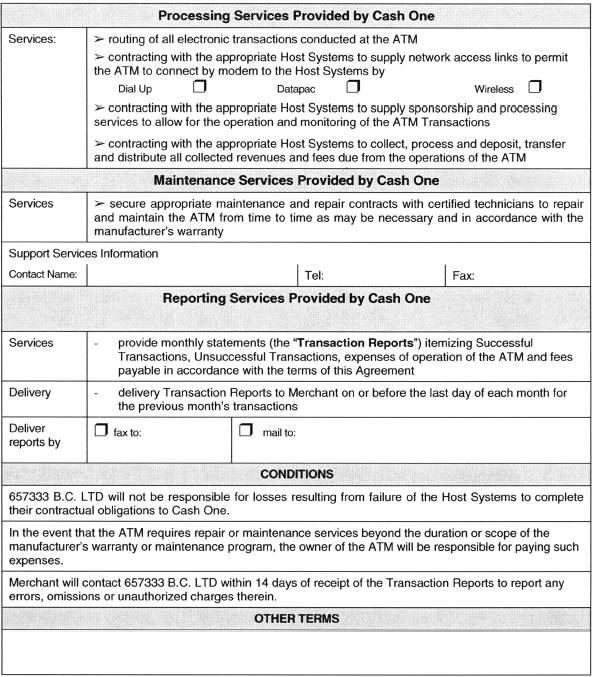

2.04 Merchant and 657333 B.C. LTD agree that 657333 B.C. LTD will provide the processing and maintenance services set out in Schedule C during the term of this Agreement and for so long as the ATM is located in the ATM Rental Space.

Reporting

2.05 Merchant and 657333 B.C. LTD agree that 657333 B.C. LTD will provide Merchant with monthly reports (the "Transaction Reports") as set out in Schedule C.

Payment Terms

2.06 657333 B.C. LTD will pay the Rental Fee to Merchant in arrears on or before the last day of the month following the month in which the transactions occur.

Acknowledgements

2.07 Each party agrees and acknowledges that

| (a) | during the term of this Agreement, 657333 B.C. LTD will be the sole provider of banking, cash dispensing and other ancillary services and functions provided by the ATM on the Premises; |

| (b) | the ATM installed is and will continue to be the exclusive property of the ATM Owner and Merchant holds no interest to or title in such ATM and Merchant will execute all necessary documentation to evidence the ATM Owner's interest in the ATM; |

| (c) | the ATM, when installed on the Premises, in no way constitutes a fixture and, accordingly, may be replaced, upgraded, repaired or maintained at anytime and from time to time by Cash One; |

4

| (d) | during the term of this Agreement, the ATM will not be moved or relocated within the Premises without the mutual written consent of both parties; |

| (e) | if 657333 B.C. LTD is required to temporarily remove or relocate the ATM because of actions taken by the Merchant, such as remodelling or renovations, Merchant will reimburse 657333 B.C. LTD for the costs of de-installing and re-installing the ATM; |

| (f) | for as long as 657333 B.C. LTD is responsible for operating and maintaining the ATM in accordance with Sections 2.04 and 2.05, Merchant will not open, adjust, remove, disconnect, replace, repair or alter the ATM; |

| (g) | 657333 B.C. LTD may place up to five pieces of signage, advertising or identification of up to five square feet in size on the exterior or interior of the Premises for the purposes of identifying the ATM services and location, and the costs of all such signage will be the responsibility of Cash One; |

| (h) | 657333 B.C. LTD may, with prior notice to the Merchant, promote the ATM on the Premises either through advertising, promotional material, or by having personnel in attendance in or about the Premises promoting the ATM; |

| (i) | Merchant may, with the prior written consent of Cash One, promote the ATM on the Premises either through advertising or promotional material; and |

| (j) | 657333 B.C. LTD may provide various advertising, coupon and product dispensing services and programs through the ATM and will retain all revenues collected from such ancillary functions. |

PART 3

REPRESENTATIONS AND WARRANTIES

Representations and Warranties of Merchant

3.01 Merchant represents and warrants to Cash One, and acknowledges that 657333 B.C. LTD is relying upon such representations and warranties in entering into this Agreement, that:

| (a) | where Merchant is a corporation, it is duly organized and validly existing under the laws of the jurisdiction of its incorporation or continuation; |

| (b) | Merchant has requisite authority to execute, enter into and carry out the terms and conditions of this Agreement, and all other agreements and instruments contemplated hereby, and to perform his obligations hereunder and thereunder; |

| (c) | this Agreement has been duly executed and delivered by Merchant and is a legal, valid and binding agreement enforceable against Merchant in accordance with its terms; |

| (d) | Merchant has the exclusive right to rent out the ATM Rental Space to 657333 B.C. LTD for the purposes of installing and operating an ATM; |

| (e) | the use of the ATM on the Premises is a permitted use and does not violate any laws, regulations, permits or licenses or any judgement, decree, order or rule of any court or governmental authority to which Merchant or its assets is subject; |

| (f) | Merchant's execution and delivery of this Agreement and the performance of its obligations hereunder do not and will not violate, conflict with or result in a breach of any of the terms or conditions of its constating documents or any agreement or instrument to which it is bound. |

5

Representations and Warranties of Cash One

3.02 657333 B.C. LTD represents and warrants to Merchant, and acknowledges that Merchant is relying upon such representations and warranties in entering into this Agreement, that:

| (a) | 657333 B.C. LTD is a corporation duly organized and validly existing under the laws of the Province of British Columbia; |

| (b) | 657333 B.C. LTD has all requisite power and authority to execute, enter into and carry out the terms and conditions of this Agreement, and all other agreements and instruments contemplated hereby, and to perform its obligations hereunder and thereunder; |

| (c) | this Agreement has been duly executed and delivered by 657333 B.C. LTD and is a legal, valid and binding agreement enforceable against 657333 B.C. LTD in accordance with its terms; |

| (d) | Cash One's execution and delivery of this Agreement and the performance of its obligations hereunder do not and will not violate, conflict with or result in a breach of any of the terms or conditions of its constating documents or any agreement or instrument to which it is bound; |

3.03 The representations and warranties of each of Merchant and 657333 B.C. LTD contained in this Agreement will continue in full force and effect for the benefit of the other until such time as the relevant statutory limitation period for their enforceability has expired.

PART 4

COVENANTS

Covenants of Merchant

4.01 During the term of this Agreement, Merchant will:

| (a) | not encumber the ATM or any of the ATM Products; |

| (b) | provide the structural support required to house the ATM securely in the ATM Rental Space; |

| (c) | rovide to ATM users free and uninterrupted access to the ATM Rental Space and the ATM during the Merchant's normal business hours; |

| (d) | ensure that environment around the ATM is kept within normal indoor temperatures and is well lit so as to allow ATM users comfortable use of the ATM; |

| (e) | provide convenient and continuous access to electricity and telecommunications lines to permit installation and continuous operation of the ATM on the Premises; |

| (f) | not permit any bank, trust company or other firm or person to install an automatic teller machine on the Premises or to provide any cash dispensing services to the public except |

6

| as may be provided by the Merchant as an ancillary action to the ordinary course operation of its retail business; | |

| (g) | remove all other automatic teller machines from the Premises before the installation of the ATM is completed; |

| (h) | procure and maintain in full force and effect fire, theft, vandalism and extended peril or "all risk" insurance coverage for the Premises and its contents in sufficient amounts to cover the value of the ATM and the ATM Products; |

| (i) | not collect any payment from ATM Users for use of the ATM other than amounts which are normally deducted electronically through the Host Systems and at the ATM User's bank; |

| (j) | execute all such documents and do all such other things as are reasonably requested by 657333 B.C. LTD to allow for the operation of the ATM on the Premises; |

| (k) | not give any warranty, make any representation or obligate, or contract on behalf of, 657333 B.C. LTD with respect to the ATM or otherwise except as authorized by 657333 B.C. LTD in writing; and |

| (l) | permit 657333 B.C. LTD technicians to inspect the ATM on the Premises to ensure that the ATM is operating properly. |

Covenants of Cash One

4.02 During the term of this Agreement, 657333 B.C. LTD will:

| (a) | install, within 45 days' of the date hereof, the ATM in the ATM Rental Space and, from time to time, ensure that the ATM is properly installed therein; |

| (b) | be responsible for ongoing maintenance and operation of the ATM as required by this Agreement; |

| (c) | obtain and keep in full force and effect all necessary permits required by law for the installation and operation of the ATM; |

| (d) | ensure that the ATM is operating in compliance with all applicable laws and regulations and in accordance with the contractual requirements of the manufacturer of the ATM, the telecommunications and information systems providers and the Host Systems; |

| (e) | ensure that all signage, advertising and identification placed by 657333 B.C. LTD does not violate any municipal by-laws or rules; |

| (f) | procure and maintain in full force and effect such insurance, which in its sole discretion it considers necessary, for the protection against loss of or damage to the ATM and the contents thereof; and |

| (g) | be responsible for keeping the ATM supplied with sufficient cash, receipt paper and all other materials necessary to maintain operation of the ATM and to meet the needs of ATM Users. |

PART 5

CONFIDENTIALITY AND NON-COMPETITION

7

Confidentiality

5.01 Each party will keep the terms and conditions of this Agreement in strict confidence.

Trade Secrets

5.02 All equipment, correspondence, price lists, brochures, records, training and educational materials and other documents of any sort for use in Cash One's business that are furnished by 657333 B.C. LTD to Merchant will remain the exclusive property of Cash One. Merchant agrees to surrender all such documents to 657333 B.C. LTD upon demand in the event of the termination of this Agreement. All discoveries, inventions and innovations, whether patentable or not, including all data and records pertaining thereto which Merchant may discover or originate relating to the ATM Products and their use will remain the exclusive property of Cash One.

Terms of Competition

5.03 Neither party nor any of its affiliates is prevented from engaging in any other business or activity for its exclusive benefit except as specifically stated in this Agreement, provided that such activity does not infringe the intellectual property rights of the other.

5.04 During the term of this Agreement and for a period of 6 months thereafter, Merchant will not, without the prior written consent of 657333 B.C. LTD or in accordance with the terms of this Agreement, directly or indirectly, carry on or be engaged in or be concerned with or interested in any business similar to the business carried on by Cash One, either individually or in partnership or jointly or in conjunction with any person.

Reasonable Restriction

5.05 Each party agrees that the restrictions contained in this Part are reasonable in order to protect the respective legitimate business interests of the parties and all defences to the strict enforcement of such restrictions are hereby waived by the parties.

Injunctive Relief

5.06 Each party acknowledges that a breach by it of any covenants contained in this Part could result in damages to the other party to this Agreement which damages could not adequately be compensated for by monetary award. Accordingly, each party agrees that in the event of any such breach by such party, in addition to all other remedies available to any other party at law or in equity, such other party will be entitled as a matter of right to apply to a court of competent jurisdiction for such relief by way of restraining order, injunction, decree or otherwise, as may be appropriate, to ensure compliance with the provisions of this Agreement.

Survival of Covenants

5.07 The covenants and agreements contained in this Part will survive the termination of the remainder of this Agreement and will be separate and distinct covenants and agreements enforceable after the termination of this Agreement.

PART 6

LIMITED LIABILITIES, WARRANTIES AND INDEMNITIES

Limitation of Liability

8

6.01 Except as expressly provided for in this Agreement, 657333 B.C. LTD will not be liable to Merchant or its customers for any direct, indirect, special, consequential, or punitive damages arising out of the use of the Host Systems in the operation of the ATM.

6.02 Unless expressly contained in this Agreement, no oral or written representation or statement made by 657333 B.C. LTD or any of its agents or employees including, but not limited to, any specifications, descriptions or statements contained in user guides provided to Merchant is binding upon 657333 B.C. LTD as a warranty or promise of performance. 657333 B.C. LTD does not make any warranties or promises, express or implied, with respect to the merchantability, fitness for use, condition, durability or suitability of the ATM and is not responsible for any patent or latent defects in the ATM or damages resulting there from.

Indemnification

6.03 Without prejudice to any other remedy available to a party (the "Indemnified Party") at law or in equity, each party (the "Indemnifying Party") will indemnify the Indemnified Party against any and all costs, losses, damages or expenses suffered or incurred by the Indemnified Party arising out of or relating to

| (a) | any representation or warranty of the Indemnifying Party set forth in this Agreement being untrue or incorrect |

| (b) | the failure of the Indemnifying Party to observe or perform any of its covenants or obligations pursuant hereto, and |

| (c) | any and all taxes, actions, suits, proceedings, demands, assessments, judgments, reasonable costs and reasonable legal and other expenses incidental to any of the foregoing. |

6.04 A party making a claim for indemnification pursuant to this Part will diligently take reasonable steps, short of litigation, necessary or desirable to obtain any insurance proceeds that are available to it form any insurer in respect of the matter for which a claim for indemnification is made. Any liability of the other party in respect of such claim will be reduced to the extent such insurance proceeds are received or would have been received but for want of diligence by the insured in claiming under such insurance (less, in each case, related expenses of collection). Nothing in this Section will be enforceable by an Indemnifying Party if it would materially impair the Indemnified Party's rights against its insurer.

6.05 Any claims hereunder must exceed $500 in the aggregate before any claim is made, in which event all damages or deficiencies may be claimed and not just such excess amounts.

No Other Compensation

6.06 Except as expressly provided in this Agreement, neither party will demand compensation of any kind from the other and each party will bear its own costs (including taxes), risks and liabilities arising out of its obligations and efforts under this Agreement. Without limiting the foregoing, 657333 B.C. LTD will not be liable to Merchant, Merchant's customers or any other party for:

| (a) | any unauthorized use of, or the completion of any unauthorized ATM Transactions through, the ATM; |

9

| (b) | any damages, losses, or loss of income that occurs from breakdown, non-operation, repairs or malfunctions of the ATM; or |

| (c) | any other special incidental or consequential damages caused by the use, misuse or inability to benefit from any services, hardware, or software relating to the ATM Products. |

PART 7

FORCE MAJEURE

Force Majeure

7.01 Neither party will be liable for its failure to perform any of its obligations under this Agreement due to an event of Force Majeure.

Elimination of Event of Force Majeure

7.02 A party will take all reasonable steps to eliminate an event of Force Majeure and, if possible, will perform its obligations under this Agreement as far as practical, but nothing herein will require the party to questions or test the validity of any law, rule, regulation or order of any governmental authority or to complete its obligations in any event of Force Majeure renders completion impossible.

Time Limits Extended

7.03 All time limits imposed by this Agreement will be extended by a period equivalent to the period of delay resulting from an event of Force Majeure provided that where such event of Force Majeure continues for a period longer than two months, this Agreement may be terminated by delivering written notice to the other party hereto and, if so terminated, Section 8.06 will apply.

PART 8

TERMINATION

Event of Default

8.01 In this Part, Event of Default, in relation to a party hereto, means an event of default arising as a result of a party being subject to one or more of the following circumstances,

| (a) | such party commits a material default in observing or performing any other material covenant, agreement or condition of this Agreement on its part to be observed or performed and, where such breach is curable, does not rectify or cure such breach within 30 days after receipt of written notice from another party to this Agreement specifying such breach; |

| (b) | an order is made or a resolution is passed or a petition is filed by such party for the liquidation, dissolution or winding-up of such party, |

| (c) | such party commits an act of bankruptcy, makes an assignment of its assets, is adjudged or declared bankrupt or makes an assignment for the benefit of creditors, consents to a proposal or similar action under any bankruptcy or insolvency legislation applicable to it, or commences any other proceedings relating to it under any insolvency, arrangement, readjustment of debt, |

10

| dissolution or liquidation law or statute of any jurisdiction whether now or hereafter in effect, or consents to any such proceeding; or | |

| (d) | such party enters into an agreement to sell all or substantially all of its business or transfer all or substantially all of its assets to another person. |

Initial Term

8.02 Subject to the other provisions of this Part, the initial term (the "Initial Term") of this Agreement continue in full force and effect for a term of 5 years from the date hereof.

Subsequent Terms

8.03 The Initial Term shall automatically be extended for successive additional five -year periods, upon the same terms and conditions as set out herein, unless terminated on 90 days' written notice in advance of the commencement of such subsequent term by either party to the other.

Early Termination

8.04 Notwithstanding any other section in this Part, 657333 B.C. LTD may terminate this Agreement at anytime on 14 days' written notice if:

| (a) | Merchant is the subject of an Event of Default; |

| (b) | the number of ATM Transactions is less than 2,000 in the preceding month; |

| (c) | where 657333 B.C. LTD is not the ATM Owner, title to the ATM is transferred, whether voluntarily by agreement or by operation of law [CHECK]. |

8.05 Merchant may terminate this Agreement

| (a) | on 14 days' written notice if 657333 B.C. LTD is subject to an Event of Default; |

| (b) | at anytime on 3 months' written notice, provided that Merchant pays a cancellation fee to 657333 B.C. LTD equal to % of the average monthly Surcharge Fees received from the ATM for the previous 4 months multiplied by the number of months remaining in the term. |

8.06 Upon termination of this Agreement in accordance with this Part, and in addition to any other remedies that a non-defaulting party may have:

| (a) | each party will pay to the other all fees accrued but unpaid up to the date of termination in accordance with the terms of this Agreement; |

| (b) | 657333 B.C. LTD will, at its own expense, remove the ATM and all signage and identification relating thereto from the Premises; |

| (c) | Upon removal of the ATM from the Premises, |

11

| (i) | to make good or repair the site following the removal of the ATM, unless such removal resulted in excessive damage beyond that reasonably required to remove the ATM, and | |

| (ii) | otherwise, 657333 B.C. LTD will restore the ATM site to its original condition, save and except for reasonable wear and tear and damage caused by the Merchant or its patrons. |

PART 9

DISPUTE RESOLUTION

Submission of Disputes

9.01 Either party may submit the dispute under this Agreement to arbitration in accordance with the terms of this Part.

9.02 All disputes submitted to arbitration pursuant to this Part will be decided by a single arbitrator appointed and acting under the Rules of the British Columbia International Commercial Arbitration Centre (the "BCICAC"). The arbitration award will be passed in writing, will contain the reasons for the award as well as a decision regarding the costs of arbitration, and will be final and binding upon the parties.

9.03 Each of the parties will continue to perform its respective obligations hereunder until a decision has been rendered by an arbitrator in accordance with this Part, unless the Agreement is terminated or expires in accordance with its terms.

9.04 Nothing in this Part will limit the rights of either party to apply to a court of competent jurisdiction for equitable relief by way of restraining order, injunction, decree or otherwise, as may be appropriate, to ensure compliance with the provisions of this Agreement pending final disposition of arbitration proceedings.

PART 10

GENERAL

No Joint Venture, Partnership

10.01 This Agreement is not intended by the parties to constitute or create a joint venture or partnership. Neither party will have the authority to bind the other.

Independent Legal Advice

10.02 Each of the parties hereto acknowledges and confirms that it has been advised by the Corporation to obtain independent legal advice in respect of this Agreement and has either done so or waives its rights to do so.

Notice

10.03 Any notice, direction or other communication required or permitted to be given or made under this Agreement shall be in writing and shall be well and sufficiently given or made if:

| (a) | enclosed in a sealed envelope and delivered in person and left with the party hereto to whom or to whose care it is addressed (or in the case of a corporate party, with a |

12

| receptionist or other responsible employee of the party) at the relevant address set forth on the face page of this Agreement; or | |

| (b) | telexed, telegraphed, telecopied or sent by other means of recorded electronic communication to the party hereto to whom it is addressed. |

Any notice so given or made shall be deemed to have been given or made on the day of delivery, if delivered, and on the day of sending if sent by telex, telegraph, telecopy or other means of recorded electronic communication (provided such day of delivery or sending is a business day and if not then on the first business day thereafter). Any party to this Agreement may change its address for notice by notice to the other parties to this Agreement given in the manner set out in this Section.

General Provisions

10.04 Time shall be of the essence in this Agreement.

10.05 Except as otherwise provided herein, this Agreement and the rights of any party to this Agreement may not be assigned or made the subject of any trust in favour of any person without the prior written consent of all other parties to this Agreement.

10.06 No indulgence or forbearance by any of the parties to this Agreement shall be deemed to constitute a waiver of such parties' rights to insist on a performance in full and in a timely manner of all covenants contained herein. Any waiver, in order to be binding upon any party must be expressed in writing. No waiver of any provisions, conditions or covenants shall be deemed to be a waiver of the rights of any party to require full and timely compliance with the other terms, conditions or covenants, or with the same terms, conditions or covenants at a time thereafter.

10.07 This Agreement will be governed by the laws of the Province of British Columbia and the federal laws of Canada applicable thereto. Subject to Part 9, the parties submit and attorn to the jurisdiction of the courts of the Province of British Columbia.

10.08 This Agreement may only be amended by written agreement entered into and executed by all parties to the Agreement at the effective date of the amendment.

10.09 This Agreement maybe executed in several counterparts or by facsimile signature, each such counterpart and facsimile constituting an original and all of which, when so executed, together shall constitute this Agreement, and notwithstanding their date of execution such counterparts and facsimiles shall be deemed to bear the date first written above.

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the date first written above.

| 65733 B.C. Ltd. | GOOD MORNING |

| Per: /s/ Mario Aiello | Per: /s/ Badry Walji |

| Title: Director | Title: General Manager |

| Name: Mario Aiello | Name: Badry Walji |

13

SCHEDULE A

LOCATION MAP SHOWING SITE OF ATM ON THE PREMISES

14

SCHEDULE B

ATM INSTALLATION APPLICATION AND TERMS

Installation: By completing this application form, Merchant agrees that 657333 B.C. LTD will install the ATM at the ATM Rental Space in compliance with all local, federal and provincial laws and regulations and will pay Merchant the Rental Fees set out below.

1

SCHEDULE C

ATM SUPPORT SERVICES TERMS AND FEES

2