Sample Business Contracts

California-San Jose-148 Brokaw Road Lease - San Jose Technology Properties LLC and SiRF Technology Inc.

Free Customizable Lease Forms

- Commercial Lease. Start a state-specific lease for the rental of commercial property. Specify the term and rent due, as well as whether the landlord or tenant is responsible for property taxes, insurance, and maintenance and repairs.

- Commercial Sublease. When a tenant vacates commercial property before the lease term has expired, it may be able to rent the premises to a third party. The tenant would be the sublessor and the third party would be the sublessee. Besides preparing a sublease, both parties will want to review the provisions for assignment or subletting in the original lease agreement between the landlord and the sublessor.

- Sublease Agreement. Tenants of residential property should prepare a sublease agreement if they are seeking to sublease a room or the entire apartment or house to a third party. All parties should review the original lease agreement to see if there are any restrictions on subletting or assigning the premises.

- Triple Net Lease. Triple net leases are a type of commercial leases where the tenant has to pay for property taxes, insurance, utilities, and maintenance, in addition to the monthly rent.

- Office Space Lease. When renting an office space, tenants should understand the amount of the rent and duration of the lease. Other important terms include whether the space can be subleased, which parties are responsible for maintenance, and whether any furniture and furnishings will be provided.

Sponsored Links

LEASE

BY AND BETWEEN

SAN JOSE TECHNOLOGY PROPERTIES, LLC,

a Delaware limited liability company

as Landlord

and

SIRF TECHNOLOGY, INC.

a California corporation

as Tenant

For Premises located at

148 Brokaw Road, San Jose, CA

TABLE OF CONTENTS

| Page | ||

|

SUMMARY OF BASIC LEASE TERMS | 1 | |

|

ARTICLE 1 DEFINITIONS | 1 | |

|

ARTICLE 2 DEMISE, CONSTRUCTION, AND ACCEPTANCE | 3 | |

|

ARTICLE 3 RENT | 4 | |

|

ARTICLE 4 USE OF PREMISES | 5 | |

|

ARTICLE 5 TRADE FIXTURES AND ALTERATIONS | 7 | |

|

ARTICLE 6 REPAIR AND MAINTENANCE | 8 | |

|

ARTICLE 7 WASTE DISPOSAL AND UTILITIES | 10 | |

|

ARTICLE 8 COMMON OPERATING EXPENSES | 11 | |

|

ARTICLE 9 INSURANCE | 13 | |

|

ARTICLE 10 LIMITATION ON LANDLORD’S LIABILITY AND INDEMNITY | 15 | |

|

ARTICLE 11 DAMAGE TO PREMISES | 15 | |

|

ARTICLE 12 CONDEMNATION | 17 | |

|

ARTICLE 13 DEFAULT AND REMEDIES | 18 | |

|

ARTICLE 14 ASSIGNMENT AND SUBLETTING | 20 | |

|

ARTICLE 15 GENERAL PROVISIONS | 23 | |

SUMMARY OF BASIC LEASE TERMS

|

SECTION | TERMS | |||

|

(LEASE REFERENCE) | ||||

|

A. (Introduction) | Lease Reference Date: | September 23, 1999 | ||

|

B. (Introduction) | Landlord: |

SAN JOSE TECHNOLOGY PROPERTIES, LLC a Delaware limited liability company | ||

|

C. (Introduction) | Tenant: |

SIRF TECHNOLOGY, INC. a California corporation | ||

|

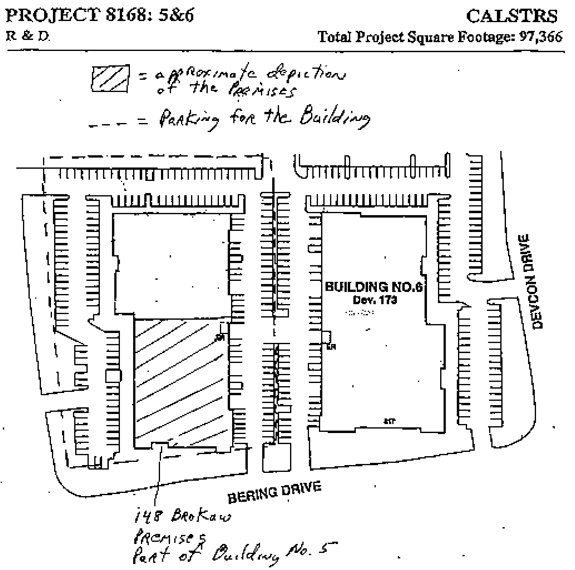

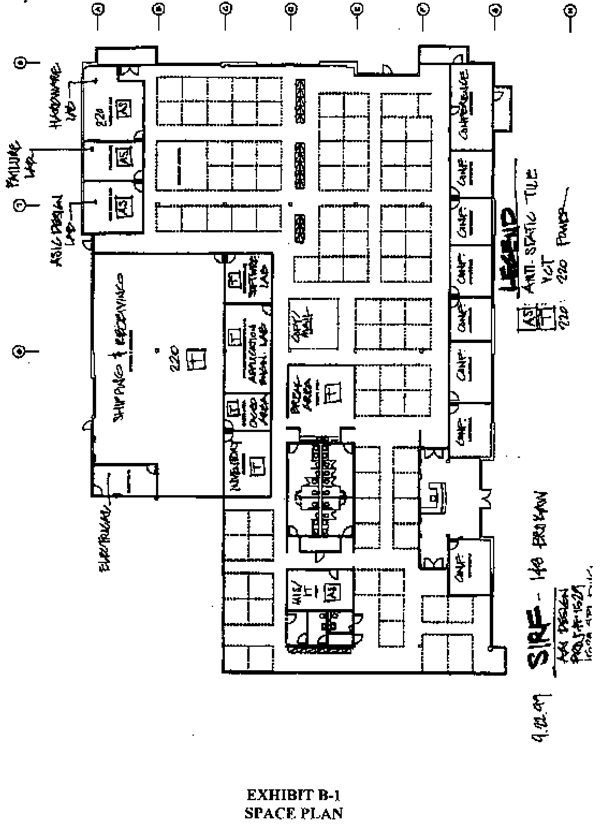

D. (§ 1.21) | Premises: | That area consisting of approximately 24,666 square feet of gross leasable area the address of which is 148 Brokaw Road, San Jose, CA, within the Building as shown on Exhibit A. | ||

|

E. (§ 1.22) | Project: | The land and improvements shown on Exhibit A consisting of the Building referred to below and another commercial buildings containing approximately 48,700 gross leasable area. | ||

|

F. (§ 1.7) | Building: | The building in which the Premises are located known as 148 Brokaw, Road, San Jose, CA containing 48,666 square feet of gross leasable area. | ||

|

G. (§ 1.29) | Tenant’s Share: |

50.68% of the Building (24,666/48,666) 25.33% of the Project (24,666/97,366) | ||

|

H. (§ 4.5) | Tenant’s Allocated Parking Stalls: Tenant shall be entitled to use Tenant’s Share the parking available to the Building, which parking for the Building is outlined in Exhibit A attached hereto. | |||

|

I. (§ 1.26) | Scheduled Commencement Date: December 1, 1999 | |||

|

J. (§ 1.18) | Lease Term: Eighty-four (84) calendar months following the Commencement Date, plus, if the Commencement Date is other than the first day of the calendar month, the remainder of the calendar month in which the Commencement Date occurs. If the Commencement Date is other than the first day of a calendar month, the first month shall include the remainder of the calendar month in which the Commencement Date occurs plus the first full calendar month thereafter, and Base Monthly Rent for such first month shall include the full Base Monthly Rent for the first full calendar month plus Base Monthly Rent for the partial month in which the Commencement Date occurs prorated on a daily basis as hereinafter provided. | |||

|

K. (§ 3.1) | Base Monthly Rent: Monthly Period | Monthly Amount | ||

|

1 – 12 13 – 24 |

$40,698.90 $41,932.20 | |||

1

|

25 – 36 37 – 48 49 – 60 61 – 72 73 – 84 |

$43,165.50 $44,398.80 $45,632.10 $46,865.40 $48,098.70 | |||

|

L. (§ 3.3) | Prepaid Rent: |

$40,698.90 | ||

|

M. (§ 3.5) | Security Deposit: | $192,394.80, of which not more than $96,197.40 may be in the form of a Letter of Credit (as defined in Addendum No. 1 attached hereto) and the balance in the form of cash. See Addendum No. 1 attached hereto. | ||

|

N. (§ 4.1) | Permitted Use: | General office use, software development, research and development. | ||

|

O. (§ 5.2) | Permitted Tenant’s Alterations limit: $15,000.00 | |||

|

P. (§ 9.1) | Tenant’s Liability Insurance Minimum: $3,000,000.00 | |||

|

Q. (§ 1.3) | Landlord’s Address: |

c/o The Martin Group 2290 North First Street, Suite 108 San Jose, California 95131 Attn: Property Manager | ||

| With a copy to: |

Divco West Group, LLC 150 Almaden Blvd., Suite 700 San Jose, CA 95113 Attn.: Asset Manager | |||

|

R. (§ 1.3) |

Tenant’s Address: Before the Commencement Date: | |||

|

Sirf Technologies, Inc. 3970 Freedom Circle Santa Clara, CA 95054 Attn.: Robert H. Bagheri, Vice President Operations | ||||

|

From and after the Commencement Date: At the Premises, attn.: Robert H. Bagheri, Vice President Operations | ||||

|

S. (§ 15.13) | Retained Real Estate Brokers: Cornish & Carey representing Landlord and Steve Horton of Commercial Property Services representing Tenant. | |||

|

T. (§ 1.17) | Lease: | This Lease includes the summary of the Basic Lease Terms, the Lease, and the following exhibits and addenda which are attached hereto and incorporated herein by this reference. | ||

| Exhibit A - Project Site Plan and Outline of the Premises | ||||

2

|

Exhibit B - Improvement Agreement Exhibit C - Acceptance Agreement Addendum No. 1 | ||||

The foregoing Summary is hereby incorporated into and made a part of this Lease. Each reference in this Lease to any term of the Summary shall mean the respective information set forth above and shall be construed to incorporate all of the terms provided under the particular paragraph pertaining to such information. In the event of any conflict between the Summary and the Lease, the Summary shall control.

|

LANDLORD: |

TENANT: | |||||

|

SAN JOSE TECHNOLOGY PROPERTIES, LLC |

By: |

SIRF TECHNOLOGY, INC. a California corporation | ||||

|

a Delaware limited liability company | ||||||

|

By: |

Diveo West Group, LLC, a Delaware limited liability company Its Agent |

By: /s/ Jackson Hu | ||||

|

Name: Jackson Hu | ||||||

|

Title: President & CEO | ||||||

|

By: /s/ Scott Smithers |

By: /s/ Robert H. Bagheri | |||||

|

Name: Scott Smithers Its: President |

Name: Robert H. Bagheri | |||||

|

Title: Vice President Operations | ||||||

|

Dated: September 27, 1999 |

Dated: September , 1999 | |||||

3

LEASE

This Lease is dated as of the lease reference date specified in Section A of the Summary and is made by and between the party identified as Landlord in Section B of the Summary and the party identified as Tenant in Section C of the Summary.

ARTICLE 1 DEFINITIONS

1.1 General: Any initially capitalized term that is given a special meaning by this Article 1, the Summary, or by any other provision of this Lease (including the exhibits attached hereto) shall have such meaning when used in this Lease or any addendum or amendment hereto unless otherwise clearly indicated by the context.

1.2 Additional Rent: The term “Additional Rent” is defined in ¶3.2.

1.3 Address for Notices: The term “Address for Notices” shall mean the addresses set forth in Sections Q and R of the Summary; provided, however, that after the Commencement Date, Tenant’s Address for Notices shall be the address of the Premises.

1.4 Agents: The term “Agents” shall mean the following: (i) with respect to Landlord or Tenant, the agents, employees, contractors, and invitees of such party; and (ii) in addition with respect to Tenant, Tenant’s subtenants and their respective agents, employees, contractors, and invitees.

1.5 Agreed Interest Rate: The term “Agreed Interest Rate” shall mean that interest rate determined as of the time it is to be applied that is equal to the lesser of (i) 5% in excess of the discount rate established by the Federal Reserve Bank of San Francisco as it may be adjusted from time to time, or (ii) the maximum interest rate permitted by Law.

1.6 Base Monthly Rent: The term “Base Monthly Rent” shall mean the fixed monthly rent payable by Tenant pursuant to ¶3.1 which is specified in Section K of the Summary.

1.7 Building: The term “Building” shall mean the building in which the Premises are located which Building is identified in Section F of the Summary, the gross leasable area of which is referred to herein as the “Building Gross Leasable Area.”

1.8 Commencement Date: The term “Commencement Date” shall mean the earlier of: (i) the date Landlord offers to deliver possession of the Premises to Tenant following “Substantial Completion” of the “Tenant Improvements” (as such terms are defined in Exhibit B attached hereto) except for such work as Landlord is required to perform but cannot complete until Tenant performs necessary portions of construction work it has elected or is required to do; or (ii) the date Tenant enters into occupancy of the Premises. To the extent the Commencement Date is delayed due to any “Tenant Delay” (as defined in Exhibit B attached hereto), then the calculation of the date under clause (i) above shall be deemed the date the Tenant Improvements would have been Substantially Completed (as defined in Exhibit B) but for such Tenant Delay.

1.9 Common Area: The term “Common Area” shall mean all areas and facilities within the Project that are not designated by Landlord for the exclusive use of Tenant or any other lessee or other occupant of the Project, including the parking areas, access and perimeter roads, pedestrian sidewalks, landscaped areas, trash enclosures, recreation areas and the like.

1.10 Common Operating Expenses: The term “Common Operating Expenses” is defined in ¶8.2.

1

to prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay any rent due under this Lease in a timely fashion, including any right to terminate this Lease pursuant to ¶13.2B.

1.11 Effective Date: The term “Effective Date” shall mean the date the last signatory to this Lease whose execution is required to make it binding on the parties hereto shall have executed this Lease.

1.12 Event of Tenant’s Default: The term “Event of Tenants Default” is defined in ¶13.1.

1.13 Hazardous Materials: The terms “Hazardous Materials” and “Hazardous Materials Laws” are defined in ¶7.2E.

1.14 Insured and Uninsured Peril: The terms “Insured Peril” and “Uninsured Peril” are defined in ¶11.2E.

1.15 Law: The term “Law” shall mean any judicial decision, statute, constitution, ordinance, resolution, regulation, rule, administrative order, or other requirement of any municipal, county, state, federal or other government agency or authority having jurisdiction over the parties to this Lease or the Premises, or both, in effect either at the Effective Date or any time during the Lease Term, including, without limitation, any Hazardous Material Law (as defined in ¶7.2E) and the Americans with Disabilities Act, 42 U.S.C. §§ 12101 et. seq. and any rules, regulations, restrictions, guidelines, requirements or publications promulgated or published pursuant thereto.

1.16 Lease: The term “Lease” shall mean the Summary and all elements of this Lease identified in Section T of the Summary, all of which are attached hereto and incorporated herein by this reference.

1.17 Lease Term: The term “Lease Term” shall mean the term of this Lease which shall commence on the Commencement Date and continue for the period specified in Section J of the Summary.

1.18 Lender: The term “Lender” shall mean any beneficiary, mortgagee, secured party, lessor, or other holder of any Security Instrument.

1.19 Permitted Use: The term “Permitted Use” shall mean the use specified in Section N of the Summary.

1.20 Premises: The term “Premises” shall mean that building area described in Section D of the Summary that is within the Building.

1.21 Project: The term “Project” shall mean that real property and the improvements thereon which are specified in Section E of the Summary, the aggregate gross leasable area of which is referred to herein as the “Project Gross Leasable Area.”

1.22 Private Restrictions: The term “Private Restrictions” shall mean all recorded covenants, conditions and restrictions, private agreements, reciprocal easement agreements, and any other recorded instruments affecting the use of the Premises which (i) exist as of the Effective Date, or (ii) are recorded after the Effective Date and are approved by Tenant.

1.23 Real Property Taxes: The term “Real Property Taxes” is defined in ¶8.3.

1.24 Scheduled Commencement Date: The term “Scheduled Commencement Date” shall mean the date specified in Section I of the Summary.

1.25 Security Instrument: The term “Security Instrument” shall mean any underlying lease, mortgage or deed of trust which now or hereafter affects the Project, and any renewal, modification, consolidation, replacement or extension thereof.

1.26 Summary: The term “Summary” shall mean the Summary of Basic Lease Terms executed by Landlord and Tenant that is part of this Lease.

2

1.27 Tenant’s Alterations: The term “Tenant’s Alterations” shall mean all improvements, additions, alterations, and fixtures installed in the Premises by Tenant at its expense which are not Trade Fixtures.

1.28 Tenant’s Share: The term “Tenant’s Share” shall mean the percentage obtained by dividing Tenant’s gross leasable area identified in Section D of the Summary by the Building Gross Leasable Area, which as of the Effective Date is the percentage identified in Section G of the Summary. While Tenant is obligated to pay a reduced Base Monthly Rent during the first month of the Lease Term, no such reduction shall apply to Tenant’s obligation to pay Tenant’s Share of Common Operating Expenses, Taxes and all other charges and sums under this Lease, and Tenant’s Share shall be calculated based on the total gross leasable area of the Premises.

1.29 Trade Fixtures: The term “Trade Fixtures” shall mean (i) Tenant’s inventory, furniture, signs, and business equipment, and (ii) anything affixed to the Premises by Tenant at its expense for purposes of trade, manufacture, ornament or domestic use (except replacement of similar work or material originally installed by Landlord) which can be removed without material injury to the Premises unless such thing has, by the manner in which it is affixed, become an integral part of the Premises.

ARTICLE 2 DEMISE, CONSTRUCTION, AND ACCEPTANCE

2.1 Demise of Premises: Landlord hereby leases to Tenant, and Tenant leases from Landlord, for the Lease Term upon the terms and conditions of this Lease, the Premises for Tenant’s own use in the conduct of Tenant’s business together with (i) the non-exclusive right to use the number of Tenants Allocated Parking Stalls within the Common Area (subject to the limitations set forth in ¶4.5), and (ii) the non-exclusive right to use the Common Area for ingress to and egress from the Premises. Landlord reserves the use of the exterior walls, the roof and the area beneath and above the Premises, together with the right to install, maintain, use, and replace ducts, wires, conduits and pipes leading through the Premises in locations which will not materially interfere with Tenant’s use of the Premises.

2.2 Commencement Date: The Scheduled Commencement Date shall be only an estimate of the actual Commencement Date, and the term of this Lease shall begin on the Commencement Date (as defined in Article 1).

2.3 Construction of Improvements: Prior to the Commencement Date, Landlord shall construct certain improvements that shall constitute or become part of the Premises if required by, and then in accordance with, the terms of Exhibit B.

2.4 Delivery and Acceptance of Possession: If this Lease provides that Landlord must deliver possession of the Premises to Tenant on a certain date, then if Landlord is unable to deliver possession of the Premises to Tenant on or before such date for any reason whatsoever, this Lease shall not be void or voidable for a period of 60 days thereafter (subject to further extension due to “Tenant Delays” and “Force Majeure Delays” as such terms are defined in Exhibit B attached hereto), and Landlord shall not be liable to Tenant for any loss or damage resulting therefrom. Tenant shall accept possession and enter into good faith occupancy of the entire Premises and commence the operation of its business therein within 30 days after the Commencement Date. Tenant acknowledges that it has had an opportunity to conduct, and has conducted, such inspections of the Premises as it deems necessary to evaluate its condition. Except as otherwise specifically provided herein, Tenant agrees to accept possession of the Premises in its then existing condition, “as-is,” including all patent and latent defects except as expressly provided below in this section. Tenant’s taking possession of any part of the Premises shall be deemed to be an acceptance by Tenant of any work of improvement done by Landlord in such part as complete and in accordance with the terms of this Lease except for defects of which Tenant has given Landlord written notice as hereinafter provided. At the time Landlord delivers possession of the Premises to Tenant, Landlord and Tenant shall together execute an acceptance agreement in the form attached as Exhibit C, appropriately completed. Landlord shall have no obligation to deliver possession, nor shall Tenant be entitled to take occupancy, of the Premises until such acceptance agreement has been executed, and Tenant’s obligation to pay Base Monthly Rent and Additional Rent shall not be excused or delayed because of Tenant’s failure to execute such acceptance agreement.

3

Landlord represents and warrants to its actual knowledge as of the date hereof, without independent investigation or the imputation of knowledge from any other party, that the plumbing, electrical and HVAC system are or will be in good working condition as of the Commencement Date. Within sixty (60) days after the Commencement Date, Tenant may provide Landlord with a written notice of any electrical, plumbing or building systems for the Premises that were not working as of the Commencement Date, and Landlord agrees to promptly repair such system in a manner reasonably determined by Landlord; provided, however, that Tenant’s obligation to pay Base Monthly Rent, additional rent and other sums under the Lease shall not be affected thereby. If Tenant fails to submit such a written notice to Landlord within such sixty (60) day period, Tenant agrees that it will conclusively be deemed to have found the Premises to be in satisfactory condition, with all work required of Landlord completed.

2.5 Early Occupancy: If Tenant enters or permits its contractors to enter the Premises prior to the Commencement Date with the written permission of Landlord, it shall do so upon all of the terms of this Lease (including its obligations regarding indemnity and insurance) except those regarding the obligation to pay rent, which shall commence on the Commencement Date.

ARTICLE 3 RENT

3.1 Base Monthly Rent: Commencing on the Commencement Date and continuing throughout the Lease Term, Tenant shall pay to Landlord the Base Monthly Rent set forth in Section K of the Summary.

3.2 Additional Rent: Commencing on the Commencement Date and continuing throughout the Lease Term, Tenant shall pay the following as additional rent (the “Additional Rent”): (i) any late charges or interest due Landlord pursuant to ¶3.4; (ii) Tenant’s Share of Common Operating Expenses as provided in ¶8.1; (iii) Landlord’s share of any Subrent received by Tenant upon certain assignments and sublettings as required by ¶14.1; (iv) any legal fees and costs due Landlord pursuant to ¶15.9; and (v) any other charges due Landlord pursuant to this Lease.

3.3 Payment of Rent: Concurrently with the execution of this Lease by both parties, Tenant shall pay to Landlord the amount set forth in Section L of the Summary as prepayment of rent for credit against the first installment(s) of Base Monthly Rent. All rent required to be paid in monthly installments shall be paid in advance on the first day of each calendar month during the Lease Term. If Section K of the Summary provides that the Base Monthly Rent is to be increased during the Lease Term and if the date of such increase does not fall on the first day of a calendar month, such increase shall become effective on the first day of the next calendar month. All rent shall be paid in lawful money of the United States, without any abatement, deduction or offset whatsoever (except as specifically provided in ¶11.4 and ¶12.3), and without any prior demand therefor. Rent shall be paid to Landlord at its address set forth in Section Q of the Summary, or at such other place as Landlord may designate from time to time. Tenant’s obligation to pay Base Monthly Rent and Tenant’s Share of Common Operating Expenses shall be prorated at the commencement and expiration of the Lease Term.

3.4 Late Charge, Interest and Quarterly Payments:

(a) Late Charge. Tenant acknowledges that the late payment by Tenant of any installment of rent, or any other sum of money required to be paid by Tenant under this Lease, will cause Landlord to incur certain costs and expenses not contemplated under this Lease, the exact amount of such costs being extremely difficult and impractical to fix. Such costs and expenses will include, without limitation, attorneys’ fees, administrative and collection costs, and processing and accounting expenses and other costs and expenses necessary and incidental thereto. If any Base Monthly Rent or Additional Rent is not received by Landlord from Tenant within five (5) days after receipt of written notice, Tenant shall immediately pay to Landlord a late charge equal to 5% of such delinquent rent as liquidated damages for Tenant’s failure to make timely payment; provided, however, that if Landlord has provided two notices of a late payment or default during any calendar year, Landlord shall not be obligated to provide any notice during the remainder of the calendar year and such late charge shall be due if payment is not made when due without any grace period or notice. In no event shall this provision for a late charge be deemed

4

to prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay any rent due under this Lease in a timely fashion, including any right to terminate this Lease pursuant to ¶13.2B.

(b) Interest. If any rent remains delinquent for a period in excess of ten (10) days then, in addition to such late charge, Tenant shall pay to Landlord interest on any rent that is not paid when due at the Agreed Interest Rate following the date such amount became due until paid.

(c) Quarterly Payments. If Tenant during any six (6) month period shall be more than five (5) days delinquent in the payment of any rent or other amount payable by Tenant hereunder on three (3) or more occasions, then, notwithstanding anything herein to the contrary, Landlord may, by written notice to Tenant, elect to require Tenant to pay all Base Monthly Rent and Additional Rent quarterly in advance. Such right shall be in addition to and not in lieu of any other right or remedy available to Landlord hereunder or at law on account of Tenant’s default hereunder

3.5 Security Deposit: On the Effective Date, Tenant shall deposit with Landlord the amount set forth in Section M of the Summary as security for the performance by Tenant of its obligations under this Lease, and not as prepayment of rent (the “Security Deposit”). Landlord may from time to time apply such portion of the Security Deposit as is reasonably necessary for the following purposes: (i) to remedy any default by Tenant in the payment of rent; (ii) to repair damage to the Premises caused by Tenant; (iii) to clean the Premises upon termination of the Lease; and (iv) to remedy any other default of Tenant to the extent permitted by Law and, in this regard, Tenant hereby waives any restriction on the uses to which the Security Deposit may be put contained in California Civil Code Section 1950.7. In the event the Security Deposit or any portion thereof is so used, Tenant agrees to pay to Landlord promptly upon demand an amount in cash sufficient to restore the Security Deposit to the full original amount. Landlord shall not be deemed a trustee of the Security Deposit, may use the Security Deposit in business, and shall not be required to segregate it from its general accounts. Tenant shall not be entitled to any interest on the Security Deposit. If Landlord transfers the Premises during the Lease Term, Landlord may pay the Security Deposit to any transferee of Landlord’s interest in conformity with the provisions of California Civil Code Section 1950.7 and/or any successor statute, in which event the transferring Landlord will be released from all liability for the return of the Security Deposit.

3.6 Electronic Payment: Landlord shall have the right, on not less than thirty (30) days prior written notice to Tenant (the “Electronic Payment Notice”), to require Tenant to make subsequent payments of Monthly Base Rent and Additional Rent due pursuant to the terms of this Lease by means of a federal funds wire transfer or such other method of electronic funds transfer as may be required by Landlord in its sole and absolute discretion (the “Electronic Payment”). The Electronic Payment Notice shall set forth the proper bank ABA number, account number and designation of the account to which such Electronic Payment shall be made. Tenant shall promptly notify Landlord in writing of any additional information that will be required to establish and maintain Electronic Payment from Tenant’s bank or financial institution. Landlord shall have the right, after at least ten (10) days-prior written notice to Tenant, to change the name of the depository for receipt of any Electronic Payment and to discontinue payment of any sum by Electronic Payment.

ARTICLE 4 USE OF PREMISES

4.1 Limitation on Use: Tenant shall use the Premises solely for the Permitted Use specified in Section N of the Summary, without the prior written consent of Landlord which will not be unreasonably withheld. Tenant shall not do anything in or about the Premises which will (i) cause structural injury to the Building, or (ii) cause damage to any part of the Building except to the extent reasonably necessary for the installation of Tenant’s Trade Fixtures and Tenant’s Alterations, and then only in a manner which has been first approved by Landlord in writing. Tenant shall not operate any equipment within the Premises which will (i) materially damage the Building or the Common Area, (ii) overload existing electrical systems or other mechanical equipment servicing the Building, (iii) impair the efficient operation of the sprinkler system or the heating, ventilating or air conditioning (“HVAC’) equipment within or servicing the Building, or (iv) damage, overload or corrode the sanitary sewer system. Tenant shall not attach, hang or suspend anything from the ceiling, roof, walls or columns of the Building or set any load on the floor in excess of the load limits for which such items are designed nor operate hard wheel forklifts within the

5

Premises. Any dust, fumes, or waste products generated by Tenant’s use of the Premises shall be contained and disposed so that they do not (i) create an unreasonable fire or health hazard, (ii) damage the Premises, or (iii) result in the violation of any Law. Except as approved by Landlord, Tenant shall not change the exterior of the Building or install any equipment or antennas on or make any penetrations of the exterior or roof of the Building. Tenant shall not commit any waste in or about the Premises, and Tenant shall keep the Premises in a neat, clean, attractive and orderly condition, free of any nuisances. If Landlord designates a standard window covering for use throughout the Building, Tenant shall use this standard window covering to cover all windows in the Premises. Tenant shall not conduct on any portion of the Premises or the Project any public or private auction, fire sale, going-out-of-business sale, distress sale or other liquidation sale. Notwithstanding the foregoing, Tenant may conduct sales and marketing of its products in the ordinary course of its ongoing business.

4.2 Compliance with Regulations: Tenant shall not use the Premises in any manner which violates any Laws or Private Restrictions which affect the Premises. Tenant shall abide by and promptly observe and comply with all Laws and Private Restrictions. Tenant shall not use the Premises in any manner which will cause a cancellation of any insurance policy covering Tenant’s Alternations or any improvements installed by Landlord at its expense or which poses an unreasonable risk of damage or injury to the Premises. Tenant shall not sell, or permit to be kept, used, or sold in or about the Premises any article which may be prohibited by the standard form of fire insurance policy. Tenant shall comply with all reasonable requirements of any insurance company, insurance underwriter, or Board of Fire Underwriters which are necessary to maintain the insurance coverage carried by either Landlord or Tenant pursuant to this Lease.

4.3 Outside Areas: No materials, supplies, tanks or containers, equipment, finished products or semi-finished products, raw materials, inoperable vehicles or articles of any nature shall be stored upon or permitted to remain outside of the Premises except in fully fenced and screened areas outside the Building which have been designed for such purpose and have been approved in writing by Landlord for such use by Tenant.

4.4 Signs: Tenant shall not place on any portion of the Premises any sign, placard, lettering in or on windows, banner, displays or other advertising or communicative material which is visible from the exterior of the Building without the prior written approval of Landlord. All such approved signs shall strictly conform to all Laws, Private Restrictions, and Landlord’s sign criteria then in effect, and shall be installed at the expense of Tenant. Tenant shall maintain such signs in good condition and repair.

4.5 Parking: Tenant is allocated and shall have the non-exclusive right to use not more than the number of Tenant’s Allocated Parking Stalls contained within the Project described in Section H of the Summary for its use and the use of Tenant’s Agents, the location of which may be designated from time to time by Landlord. Tenant shall not at any time use more parking spaces than the number so allocated to Tenant or park its vehicles or the vehicles of others in any portion of the Project not designated by Landlord as a non-exclusive parking area. Tenant shall not have the exclusive right to use any specific parking space. If Landlord grants to any other tenant the exclusive right to use any particular parking space(s), Tenant shall not use such spaces. Landlord reserves the right, after having given Tenant reasonable notice, to have any vehicles owned by Tenant or Tenant’s Agents utilizing parking spaces in excess of the parking spaces allowed for Tenant’s use to be towed away at Tenant’s cost. All trucks and delivery vehicles shall be (i) parked at the rear of the Building, (ii) loaded and unloaded in a manner which does not interfere with the businesses of other occupants of the Project and (iii) permitted to remain on the Project only so long as is reasonably necessary to complete loading and unloading. In the event Landlord elects or is required by any Law to limit or control parking in the Project, whether by validation of parking tickets or any other method of assessment, Tenant agrees to participate in such validation or assessment program under such reasonable rules and regulations as are from time to time established by Landlord.

4.6 Rules and Regulations: Landlord may from time to time promulgate reasonable and nondiscriminatory rules and regulations applicable to all occupants of the Project for the care and orderly management of the Project and the safety of its tenants and invitees. Such rules and regulations shall be binding upon Tenant upon delivery of a copy thereof to Tenant, and Tenant agrees to abide by such rules and regulations. If there is a conflict between the rules and regulations and any of the provisions of this Lease, the provisions of this Lease shall prevail. Landlord shall not be responsible for the violation by any other tenant of the Project of any such rules and regulations. If there is a conflict between the rules and regulations and any of the provisions of this Lease, the provisions of this

6

Lease shall prevail. Landlord shall not be responsible for the violation by any other tenant of the Project of any such rules and regulations.

ARTICLE 5 TRADE FIXTURES AND ALTERATIONS

5.1 Trade Fixtures: Throughout the Lease Term, Tenant may provide and install, and shall maintain in good condition, any Trade Fixtures required in the conduct of its business in the Premises. All Trade Fixtures shall remain Tenant’s property.

5.2 Tenant’s Alterations: Construction by Tenant of Tenant’s Alterations shall be governed by the following:

A. Tenant shall not construct any Tenant’s Alterations or otherwise alter the Premises without Landlord’s prior written approval, which will not be unreasonably withheld, except if the Tenant’s Alteration affects the roof, structural portions of the Premises or Building, the Common Area or the electrical, plumbing or HVAC systems servicing areas outside of the Premises in which case Landlord may withhold its consent in its sole and absolute discretion. Tenant shall be entitled, without Landlord’s prior approval, to make Tenant’s Alterations (i) which do not affect the structural or exterior parts or water tight character of the Building, and (ii) the reasonably estimated cost of which, plus the original cost of any part of the Premises removed or materially altered in connection with such Tenant’s Alterations, together do not exceed the Permitted Tenant Alterations Limit specified in Section O of the Summary per work of improvement. In the event Landlord’s approval for any Tenant’s Alterations is required, Tenant shall not construct the Leasehold Improvement until Landlord has approved in writing the plans and specifications therefor, and such Tenant’s Alterations shall be constructed substantially in compliance with such approved plans and specifications by a licensed contractor first approved by Landlord. All Tenant’s Alterations constructed by Tenant shall be constructed by a licensed contractor in accordance with all Laws using new materials of good quality.

B. Tenant shall not commence construction of any Tenant’s Alterations until (i) all required governmental approvals and permits have been obtained, (ii) all requirements regarding insurance imposed by this Lease have been satisfied, (iii) Tenant has given Landlord at least five days’ prior written notice of its intention to commence such construction, and (iv) if reasonably requested by Landlord, Tenant has obtained contingent liability and broad form builders’ risk insurance in an amount reasonably satisfactory to Landlord if there are any perils relating to the proposed construction not covered by insurance carried pursuant to Article 9.

C. All Tenant’s Alterations shall remain the property of Tenant during the Lease Term but shall not be altered or removed from the Premises. At the expiration or sooner termination of the Lease Term, all Tenant’s Alterations shall be surrendered to Landlord as part of the realty and shall then become Landlord’s property, and Landlord shall have no obligation to reimburse Tenant for all or any portion of the value or cost thereof; provided, however, that if Landlord requires Tenant to remove any Tenant’s Alterations, Tenant shall so remove such Tenant’s Alterations prior to the expiration or sooner termination of the Lease Term. Notwithstanding the foregoing, Tenant shall not be obligated to remove any Tenant’s Alterations with respect to which the following is true: (i) Tenant was required, or elected, to obtain the approval of Landlord to the installation of the Tenant’s Alteration in question; (ii) at the time Tenant requested Landlord’s approval, Tenant requested of Landlord in writing that Landlord inform Tenant of whether or not Landlord would require Tenant to remove such Tenant’s Alteration at the expiration of the Lease Term; and (iii) at the time Landlord granted its approval, it did not inform Tenant that it would require Tenant to remove such Tenant’s Alteration at the expiration of the Lease Term.

5.3 Alterations Required by Law: Tenant shall make any alteration, addition or change of any sort to the Premises that is required by any Law because of (i) Tenant’s particular use or change of use of the Premises; (ii) Tenant’s application for any permit or governmental approval; or (iii) Tenant’s construction or installation of any Tenant’s Alterations or Trade Fixtures. Any other alteration, addition, or change required by Law which is not the responsibility of Tenant pursuant to the foregoing shall be made by Landlord (subject to Landlord’s right to reimbursement from Tenant specified in ¶5.4).

7

5.4 Amortization of Certain Capital Improvements: Tenant shall pay Additional Rent in the event Landlord reasonably elects or is required to make any of the following kinds of capital improvements to the Project: (i) capital improvements required to be constructed in order to comply with any Law (excluding any Hazardous Materials Law) not in effect or applicable to the Project as of the Effective Date; (ii) modification of existing or construction of additional capital improvements or building service equipment for the purpose of reducing the consumption of utility services or Common Operating Expenses of the Project; (iii) replacement of capital improvements or building service equipment existing as of the Effective Date when required because of normal wear and tear; and (iv) restoration of any part of the Project that has been damaged by any peril to the extent the cost thereof is not covered by insurance proceeds actually recovered by Landlord up to a maximum amount per occurrence of 10% of the then replacement cost of the Project. The amount of Additional Rent Tenant is to pay with respect to each such capital improvement shall be determined as follows:

A. All costs paid by Landlord to construct such improvements (including financing costs) shall be amortized over the useful life of such improvement (as reasonably determined by Landlord in accordance with generally accepted accounting principles) with interest on the unamortized balance at the then prevailing market rate Landlord would pay if it borrowed funds to construct such improvements from an institutional lender, and Landlord shall inform Tenant of the monthly amortization payment required to so amortize such costs, and shall also provide Tenant with the information upon which such determination is made.

B. As Additional Rent, Tenant shall pay at the same time the Base Monthly Rent is due an amount equal to Tenant’s Share of that portion of such monthly amortization payment fairly allocable to the Building (as reasonably determined by Landlord) for each month after such improvements are completed until the first to occur of (i) the expiration of the Lease Term (as it may be extended), or (ii) the end of the term over which such costs were amortized.

5.5 Mechanic’s Liens: Tenant shall keep the Project free from any liens and shall pay when due all bills arising out of any work performed, materials furnished, or obligations incurred by Tenant or Tenants Agents relating to the Project. If any claim of lien is recorded (except those caused by Landlord or Landlord’s Agents), Tenant shall bond against or discharge the same within 10 days after receipt of written notice that the same has been recorded against the Project. Should any lien be filed against the Project or any action be commenced affecting title to the Project, the party receiving notice of such lien or action shall immediately give the other party written notice thereof.

5.6 Taxes on Tenant’s Property: Tenant shall pay before delinquency any and all taxes, assessments, license fees and public charges levied, assessed or imposed against Tenant or Tenant’s estate in this Lease or the property of Tenant situated within the Premises which become due during the Lease Term. If any tax or other charge is assessed by any governmental agency because of the execution of this Lease, such tax shall be paid by Tenant. On demand by Landlord, Tenant shall furnish Landlord with satisfactory evidence of these payments.

ARTICLE 6 REPAIR AND MAINTENANCE

6.1 Tenant’s Obligation to Maintain: Except as otherwise provided in ¶6.2, ¶11.1, and ¶ 12.3, Tenant shall be responsible for the following during the Lease Term:

A. Tenant shall clean and maintain in good order, condition, and repair and replace when necessary the Premises and every part thereof, through regular inspections and servicing, including, but not limited to: (i) all plumbing and sewage facilities (including all sinks, toilets, faucets and drains), and all ducts, pipes, vents or other parts of the HVAC or plumbing system; (ii) all fixtures, interior walls, floors, carpets and ceilings; (iii) all windows, doors, entrances, plate glass, showcases and skylights (including cleaning both interior and exterior surfaces); (iv) all electrical facilities and all equipment (including all lighting fixtures, lamps, bulbs, tubes, fans, vents, exhaust equipment and systems); and (v) any automatic fire extinguisher equipment in the Premises.

B. With respect to utility facilities serving the Premises (including electrical wiring and conduits, gas lines, water pipes, and plumbing and sewage fixtures and pipes), Tenant shall be responsible for the

8

maintenance and repair of any such facilities which serve only the Premises, including all such facilities that are within the walls or floor, or on the roof of the Premises, and any part of such facility that is not within the Premises, but only up to the point where such facilities join a main or other junction (e.g., sewer main or electrical transformer) from which such utility services are distributed to other parts of the Project as well as to the Premises. Tenant shall replace any damaged or broken glass in the Premises (including all interior and exterior doors and windows) with glass of the same kind, size and quality. Tenant shall repair any damage to the Premises (including exterior doors and windows) caused by vandalism or any unauthorized entry.

C. Tenant shall (i) maintain, repair and replace when necessary all HVAC equipment which services only the Premises, and shall keep the same in good condition through regular inspection and servicing, and (ii) maintain continuously throughout the Lease Term a service contract for the maintenance of all such HVAC equipment with a licensed HVAC repair and maintenance contractor approved by Landlord, which contract provides for the periodic inspection and servicing of the HVAC equipment at least once every three months during the Lease Term. Notwithstanding the foregoing, Landlord may elect at any time to assume responsibility for the maintenance, repair and replacement of such HVAC equipment which serves only the Premises. Tenant shall maintain continuously throughout the Lease Term a service contract for the washing of all windows (both interior and exterior surfaces) in the Premises with a contractor approved by Landlord, which contract provides for the periodic washing of all such windows at least once every three months (or more frequently to the extent necessary) during the Lease Term. Tenant shall furnish Landlord with copies of all such service contracts, which shall provide that they may not be canceled or changed without at least 30 days’ prior written notice to Landlord.

D. All repairs and replacements required of Tenant shall be promptly made with new materials of like kind and quality. If the work affects the structural parts of the Building or if the estimated cost of any item of repair or replacement is in excess of the Permitted Tenant’s Alterations Limit, then Tenant shall first obtain Landlord’s written approval of the scope of the work, plans therefor, materials to be used, and the contractor.

6.2 Landlord’s Obligation to Maintain: Landlord shall repair, maintain and operate the Common Area and repair and maintain the roof, exterior and structural parts of the building(s) located on the Project so that the same are kept in good order and repair. If there is central HVAC or other building service equipment and/or utility facilities serving portions of the Common Area and/or both the Premises and other parts of the Building, Landlord shall maintain and operate (and replace when necessary) such equipment. Landlord shall not be responsible for repairs required by an accident, fire or other peril or for damage caused to any part of the Project by any act or omission of Tenant or Tenant’s Agents except as otherwise required by Article 11. Landlord may engage contractors of its choice to perform the obligations required of it by this Article, and the necessity of any expenditure to perform such obligations shall be at the sole discretion of Landlord.

6.3 Control of Common Area: Landlord shall at all times have exclusive control of the Common Area. Landlord shall have the right, without the same constituting an actual or constructive eviction and without entitling Tenant to any abatement of rent, to: (i) close any part of the Common Area to whatever extent required in the opinion of Landlord’s counsel to prevent a dedication thereof or the accrual of any prescriptive rights therein; (ii) temporarily close the Common Area to perform maintenance or for any other reason deemed sufficient by Landlord; (iii) change the shape, size, location and extent of the Common Area; (iv) eliminate from or add to the Project any land or improvement, including multi-deck parking structures; (v) make changes to the Common Area including, without limitation, changes in the location of driveways, entrances, passageways, doors and doorways, elevators, stairs, restrooms, exits, parking spaces, parking areas, sidewalks or the direction of the flow of traffic and the site of the Common Area; (vi) remove unauthorized persons from the Project; and/or (vii) change the name or address of the Building or Project. Tenant shall keep the Common Area clear of all obstructions created or permitted by Tenant. If in the opinion of Landlord unauthorized persons are using any of the Common Area by reason of the presence of Tenant in the Building, Tenant, upon demand of Landlord, shall restrain such unauthorized use by appropriate proceedings. In exercising any such rights regarding the Common Area, (i) Landlord shall make a reasonable effort to minimize any disruption to Tenant’s business, and (ii) Landlord shall not exercise its rights to control the Common Area in a manner that would materially interfere with Tenant’s use of the Premises without first obtaining Tenant’s consent. Landlord shall have no obligation to provide guard services or other security measures for the benefit of the Project. Tenant assumes all responsibility for the protection of Tenant and Tenant’s Agents

9

from acts of third parties; provided, however, that nothing contained herein shall prevent Landlord, at its sole option, from providing security measures for the Project.

ARTICLE 7 WASTE DISPOSAL AND UTILITIES

7.1 Waste Disposal: Tenant shall store its waste either inside the Premises or within outside trash enclosures that are fully fenced and screened in compliance with all Private Restrictions, and designed for such purpose. All entrances to such outside trash enclosures shall be kept closed, and waste shall be stored in such manner as not to be visible from the exterior of such outside enclosures. Tenant shall cause all of its waste to be regularly removed from the Premises at Tenant’s sole cost. Tenant shall keep all fire corridors and mechanical equipment rooms in the Premises free and clear of all obstructions at all times.

7.2 Hazardous Materials: Landlord and Tenant agree as follows with respect to the existence or use of Hazardous Materials on the Project:

A. Any handling, transportation, storage, treatment, disposal or use of Hazardous Materials by Tenant and Tenant’s Agents after the Effective Date in or about the Project shall strictly comply with all applicable Hazardous Materials Laws. Tenant shall indemnify, defend upon demand with counsel reasonably acceptable to Landlord, and hold harmless Landlord from and against any liabilities, losses, claims, damages, lost profits, consequential damages, interest, penalties, fines, monetary sanctions, attorneys’ fees, experts’ fees, court costs, remediation costs, investigation costs, and other expenses which result from or arise in any manner whatsoever out of the use, storage, treatment, transportation, release, or disposal of Hazardous Materials (collectively, “Hazardous Material Activity”) on or about the Project by Tenant or Tenant’s Agents after the Effective Date. The foregoing indemnity does not apply to any Hazardous Material Activity by Landlord or any third parties, other than Tenant or Tenant’s Agents. Landlord agrees during the Lease Term that Landlord will not engage in any Hazardous Material Activity in violation of any Hazardous Materials Laws.

B. If the presence of Hazardous Materials on the Project caused or permitted by Tenant or Tenant’s Agents after the Effective Date results in contamination or deterioration of water or soil resulting in a level of contamination greater than the levels established as acceptable by any governmental agency having jurisdiction over such contamination, then Tenant shall promptly take any and all action necessary to investigate and remediate such contamination if required by Law or as a condition to the issuance or continuing effectiveness of any governmental approval which relates to the use of the Project or any part thereof. Tenant shall further be responsible for, and shall defend, indemnify and hold Landlord and its agents harmless from and against all claims, costs and liabilities, including attorneys’ fees and costs, arising out of or in connection with any investigation and remediation required hereunder to return the Project to its condition existing prior to the appearance of such Hazardous Materials.

C. Landlord and Tenant shall each give written notice to the other as soon as reasonably practicable of (i) any communication received from any governmental authority concerning Hazardous Materials which relates to the Project, and (ii) any contamination of the Project by Hazardous Materials which constitutes a violation of any Hazardous Materials Law. Tenant may use small quantities of office supplies and household chemicals such as adhesives, lubricants, and cleaning fluids in order to conduct its business at the Premises and such other Hazardous Materials as are necessary for the operation of Tenant’s business of which Landlord receives notice prior to such Hazardous Materials being brought onto the Premises and which Landlord consents in writing may be brought onto the Premises. At any time during the Lease Term, Tenant shall, within five days after written request therefor received from Landlord, disclose in writing all Hazardous Materials that are being used by Tenant on the Project, the nature of such use, and the manner of storage and disposal.

D. Landlord may cause testing wells to be installed on the Project, and may cause the ground water to be tested to detect the presence of Hazardous Material by the use of such tests as are then customarily used for such purposes. If Tenant so requests, Landlord shall supply Tenant with copies of such test results. The cost of such tests and of the installation, maintenance, repair and replacement of such wells shall be

10

paid by Tenant if such tests disclose the existence of facts which give rise to liability of Tenant pursuant to its indemnity given in ¶7.2A and/or ¶7.2B.

E. As used herein, the term “Hazardous Material,” means any hazardous or toxic substance, material or waste which is or becomes regulated by any local governmental authority, the State of California or the United States Government. The term “Hazardous Material,” includes, without limitation, petroleum products, asbestos, PCB’s, and any material or substance which is (i) listed under Article 9 or defined as hazardous or extremely hazardous pursuant to Article 11 of Title 22 of the California Administrative Code, Division 4, Chapter 20, (ii) defined as a “hazardous waste” pursuant to Section 1004 of the Federal Resource Conservation and Recovery Act, 42 U.S.C. 6901 et seq. (42 U.S.C. 6903), or (iii) defined as a “hazardous substance” pursuant to Section 101 of the Comprehensive Environmental Response; Compensation and Liability Act, 42 U.S.C. 9601 et seq. (42 U.S.C. 960 1). As used herein, the term “Hazardous Material Law” shall mean any statute, law, ordinance, or regulation of any governmental body or agency (including the U.S. Environmental Protection Agency, the California Regional Water Quality Control Board, and the California Department of Health Services) which regulates the use, storage, release or disposal of any Hazardous Material.

F. The obligations of Landlord and Tenant under this ¶7.2 shall survive the expiration or earlier termination of the Lease Term. The rights and obligations of Landlord and Tenant with respect to issues relating to Hazardous Materials are exclusively established by this ¶7.2. In the event of any inconsistency between any other part of this Lease and this ¶7.2, the terms of this ¶7.2 shall control.

7.3 Utilities: Tenant shall promptly pay, as the same become due, all charges for water, gas, electricity, telephone, sewer service, waste pick-up and any other utilities, materials or services furnished directly to or used by Tenant on or about the Premises during the Lease Term, including, without limitation, (i) meter, use and/or connection fees, hook-up fees, or standby fee (excluding any connection fees or hook-up fees which relate to making the existing electrical, gas, and water service available to the Premises as of the Commencement Date), and (ii) penalties for discontinued or interrupted service. If any utility service is not separately metered to the Premises, then Tenant shall pay its pro rata share of the cost of such utility service with all others served by the service not separately metered. However, if Landlord determines that Tenant is using a disproportionate amount of any utility service not separately metered, then Landlord at its election may (i) periodically charge Tenant, as Additional Rent, a sum equal to Landlord’s reasonable estimate of the cost of Tenant’s excess use of such utility service, or (ii) install a separate meter (at Tenant’s expense) to measure the utility service supplied to the Premises.

7.4 Compliance with Governmental Regulations: Landlord and Tenant shall comply with all rules, regulations and requirements promulgated by national, state or local governmental agencies or utility suppliers concerning the use of utility services, including any rationing, limitation or other control. Tenant shall not be entitled to terminate this Lease nor to any abatement in rent by reason of such compliance.

ARTICLE 8 COMMON OPERATING EXPENSES

8.1 Tenant’s Obligation to Reimburse: As Additional Rent, Tenant shall pay Tenant’s Share (specified in Section G of the Summary) of all Common Operating Expenses; provided, however, if the Project contains more than one building, then Tenant shall pay Tenant’s Share of all Common Operating Expenses fairly allocable to the Building, including (i) all Common Operating Expenses paid with respect to the maintenance, repair, replacement and use of the Building, and (ii) a proportionate share (based on the Building Gross Leasable Area as a percentage of the Project Gross Leasable Area) of all Common Operating Expenses which relate to the Project in general are not fairly allocable to any one building that is part of the Project. Tenant shall pay such share of the actual Common Operating Expenses incurred or paid by Landlord but not theretofore billed to Tenant within 10 days after receipt of a written bill therefor from Landlord, on such periodic basis as Landlord shall designate, but in no event more frequently than once a month. Alternatively, Landlord may from time to time require that Tenant pay Tenant’s Share of Common Operating Expenses in advance in estimated monthly installments, in accordance with the following: (i) Landlord shall deliver to Tenant Landlord’s reasonable estimate of the Common Operating expenses it anticipates will be paid or incurred for the Landlord’s fiscal year in question; (ii) during such Landlord’s fiscal year Tenant shall pay such share of the estimated Common Operating Expenses in advance in monthly installments as

11

required by Landlord due with the installments of Base Monthly Rent; and (iii) within 90 days after the end of each Landlord’s fiscal year, Landlord shall furnish to Tenant a statement in reasonable detail of the actual Common Operating Expenses paid or incurred by Landlord during the just ended Landlord’s fiscal year and thereupon there shall be an adjustment between Landlord and Tenant, with payment to Landlord or credit by Landlord against the next installment of Base Monthly Rent, as the case may require, within 10 days after delivery by Landlord to Tenant of said statement, so that Landlord shall receive the entire amount of Tenant’s Share of all Common Operating Expenses for such Landlord’s fiscal year and no more. Tenant shall have the right at its expense, exercisable upon reasonable prior written notice to Landlord, to inspect at Landlord’s office during normal business hours Landlord’s books and records as they relate to Common Operating Expenses. Such inspection must be within 30 days of Tenant’s receipt of Landlord’s annual statement for the same, and shall be limited to verification of the charges contained in such statement. Tenant may not withhold payment of such bill pending completion of such inspection.

8.2 Common Operating Expenses Defined: The term “Common Operating Expenses” shall mean the following:

A. All costs and expenses paid or incurred by Landlord in doing the following (including payments to independent contractors providing services related to the performance of the following): (i) maintaining, cleaning, repairing and resurfacing the roof (including repair of leaks) and the exterior surfaces (including painting) of all buildings located on the Project; (ii) maintenance of the liability, fire, property damage, earthquake and other insurance covering the Project carried by Landlord pursuant to ¶9.2 (including the prepayment of premiums for coverage of up to one year); (iii) maintaining, repairing, operating and replacing when necessary HVAC equipment, utility facilities and other building service equipment; (iv) providing utilities to the Common Area (including lighting, trash removal and water for landscaping irrigation); (v) complying with all applicable Laws and Private Restrictions; (vi) operating, maintaining, repairing, cleaning, painting, restriping and resurfacing the Common Area; (vii) replacement or installation of lighting fixtures, directional or other signs and signals, irrigation systems, trees, shrubs, ground cover and other plant materials, and all landscaping in the Common Area; and (viii) providing security (provided, however, that Landlord shall not be obligated to provide security and if it does, Landlord may discontinue such service at any time and in any event Landlord shall not be responsible for any act or omission of any security personnel); and (ix) capital improvements as provided in ¶5.4 hereof;

B. The following costs: (i) Real Property Taxes as defined in ¶8.3; (ii) the amount of any “deductible” paid by Landlord with respect to damage caused by any Insured Peril; (iii) the cost to repair damage caused by an Uninsured Peril up to a maximum amount in any 12 month period equal to 2% of the replacement cost of the buildings or other improvements damaged; and (iv) that portion of all compensation (including benefits and premiums for workers’ compensation and other insurance) paid to or on behalf of employees of Landlord but only to the extent they are involved in the performance of the work described by ¶8.2A that is fairly allocable to the Project;

C. Reasonable and customary fees for management services rendered by either Landlord or a third party manager engaged by Landlord (which may be a party affiliated with Landlord), and the parties agree that the total amount charged for management services and included in Tenant’s Share of Common Operating Expenses shall be 5% of the Base Monthly Rent which is reasonable and customary.

D. All additional costs and expenses incurred by Landlord with respect to the operation, protection, maintenance, repair and replacement of the Project which would be considered a current expense (and not a capital expenditure) pursuant to generally accepted accounting principles; provided, however, that Common Operating Expenses shall not include any of the following: (i) payments on any loans or ground leases affecting the Project; (ii) depreciation of any buildings or any major systems of building service equipment within the Project; (iii) leasing commissions; (iv) the cost of tenant improvements installed for the exclusive use of other tenants of the Project; and (v) any cost incurred in complying with Hazardous Materials Laws, which subject is governed exclusively by ¶7.2.

8.3 Real Property Taxes Defined: The term “Real Property Taxes” shall mean all taxes, assessments, levies, and other charges of any kind or nature whatsoever, general and special, foreseen and unforeseen (including all installments of principal and interest required to pay any existing or future general or special assessments for

12

public improvements, services or benefits, and any increases resulting from reassessments resulting from a change in ownership, new construction, or any other cause), now or hereafter imposed by any governmental or quasi-governmental authority or special district having the direct or indirect power to tax or levy assessments, which are levied or assessed against, or with respect to the value, occupancy or use of all or any portion of the Project (as now constructed or as may at any time hereafter be constructed, altered, or otherwise changed) or Landlord’s interest therein, the fixtures, equipment and other property of Landlord, real or personal, that are an integral part of and located on the Project, the gross receipts, income, or rentals from the Project, or the use of parking areas, public utilities, or energy within the Project or Landlord’s business of leasing the Project. If at any time during the Lease Term the method of taxation or assessment of the Project prevailing as of the Effective Date shall be altered so that in lieu of or in addition to any Real Property Tax described above there shall be levied, assessed or imposed (whether by reason of a change in the method of taxation or assessment, creation of a new tax or charge, or any other cause) an alternate or additional tax or charge (i) on the value, use or occupancy of the Project or Landlord’s interest therein, or (ii) on or measured by the gross receipts, income or rentals from the Project, on Landlord’s business of leasing the Project, or computed in any manner with respect to the operation of the Project, then any such tax or charge, however designated, shall be included within the meaning of the term “Real Property Taxes” for purposes of this Lease. If any Real Property Tax is based upon property or rents unrelated to the Project, then only that part of such Real Property Tax that is fairly allocable to the Project shall be included within the meaning of the term “Real Property Taxes”. Notwithstanding the foregoing, the term “Real Property Taxes” shall not include estate, inheritance, transfer, gift or franchise taxes of Landlord or the federal or state net income tax imposed on Landlord’s income from all sources.

ARTICLE 9 INSURANCE

9.1 Tenant’s Insurance: Tenant shall maintain insurance complying with all of the following:

A. Tenant shall procure, pay for and keep in full force and effect the following:

(1) Commercial general liability insurance, including property damage, against liability for personal injury, bodily injury, death and damage to property occurring in or about, or resulting from an occurrence in or about, the Premises with combined single limit coverage of not less than the amount of Tenant’s Liability Insurance Minimum specified in Section P of the Summary, which insurance shall contain a “contractual liability” endorsement insuring Tenant’s performance of Tenant’s obligation to indemnify Landlord contained in ¶10.3;

(2) Fire and property damage insurance in so-called “all risk” form insuring Tenant’s Trade Fixtures and Tenant’s Alterations for the full actual replacement cost thereof;

(3) Business interruption insurance with limits of liability representing at least approximately six months of income, business auto liability covering owned, non-owned and hired vehicles with a limit of not less than $1,000,000 per accident, insurance protecting against liability under workers’ compensation laws with limits at least as required by statute, insurance for all plate glass in the Premises, and such other insurance that is either (i) required by any Lender, or (ii) reasonably required by Landlord and customarily carried by tenants of similar property in similar businesses.

B. Where applicable and required by Landlord, each policy of insurance required to be carried by Tenant pursuant to this ¶9.1: (i) shall name Landlord and such other parties in interest as Landlord reasonably designates as additional insured; (ii) shall be primary insurance which provides that the insurer shall be liable for the full amount of the loss up to and including the total amount of liability set forth in the declarations without the right of contribution from any other insurance coverage of Landlord; (iii) shall be in a form reasonably satisfactory to Landlord; (iv) shall be carried with companies reasonably acceptable to Landlord; (v) shall provide that such policy shall not be subject to cancellation, lapse or change except after at least 30 days prior written notice to Landlord so long as such provision of 30 days notice is reasonably obtainable, but in any event not less than 10 days prior written notice; (vi) shall not have a “deductible” in excess of such amount as is approved by Landlord; (vii) shall contain a cross liability endorsement; and (viii) shall contain a “severability” clause. If Tenant has in full

13

force and effect a blanket policy of liability insurance with the same coverage for the Premises as described above, as well as other coverage of other premises and properties of Tenant, or in which Tenant has some interest, such blanket insurance shall satisfy the requirements of this ¶9.1.

C. A copy of each paid-up policy evidencing the insurance required to be carried by Tenant pursuant to this ¶9.1 (appropriately authenticated by the insurer) or a certificate of the insurer, certifying that such policy has been issued, providing the coverage required by this ¶9.1, and containing the provisions specified herein, shall be delivered to Landlord prior to the time Tenant or any of its Agents enters the Premises and upon renewal of such policies, but not less than 5 days prior to the expiration of the term of such coverage. Landlord may, at any reasonable time, and from time to time, inspect and/or copy any and all insurance policies required to be procured by Tenant pursuant to this ¶9.1. If any Lender or insurance advisor reasonably determines at any time that the amount of coverage required for any policy of insurance Tenant is to obtain pursuant to this ¶9.1 is not adequate, then Tenant shall increase such coverage for such insurance to such amount as such Lender or insurance advisor reasonably deems adequate, not to exceed the level of coverage for such insurance commonly carried by comparable businesses similarly situated.

9.2 Landlord’s Insurance: Landlord shall have the following obligations and options regarding insurance:

A. Landlord shall maintain a policy or policies of fire and property damage insurance in so-called “all risk” form insuring Landlord (and such others as Landlord may designate) against loss of rents for a period of not less than 12 months and from physical damage to the Project with coverage of not less than the full replacement cost thereof. Landlord may so insure the Project separately, or may insure the Project with other property owned by Landlord which Landlord elects to insure together under the same policy or policies. Landlord shall have the right, but not the obligation, in its sole and absolute discretion, to obtain insurance for such additional perils that Landlord deems appropriate, including, without limitation, coverage for damage by earthquake and/or flood. All such coverage shall contain “deductibles” which Landlord deems appropriate, which in the case of earthquake and flood insurance, may be up to 10% of the replacement value of the property insured or such higher amount as is then commercially reasonable. Landlord shall not be required to cause such insurance to cover any-Trade Fixtures or Tenant’s Alterations of Tenant.

B. Landlord may maintain a policy or policies of commercial general liability insurance insuring Landlord (and such others as are designated by Landlord) against liability for personal injury, bodily injury, death and damage to property occurring or resulting from an occurrence in, on or about the Project, with combined single limit coverage in such amount as Landlord from time to time determines is reasonably necessary for its protection.

C. Tenant’s Obligation to Reimburse: If Landlord’s insurance rates for the Building are increased at any time during the Lease Term as a result of the nature of Tenant’s use of the Premises, Tenant shall reimburse Landlord for the full amount of such increase immediately upon receipt of a bill from Landlord therefor.

9.3 Release and Waiver of Subrogation: The parties hereto release each other, and their respective agents and employees, from any liability for injury to any person or damage to property that is caused by or results from any risk insured against under any valid and collectible insurance policy carried by either of the parties which contains a waiver of subrogation by the insurer and is in force at the time of such injury or damage; subject to the following limitations: (i) the foregoing provision shall not apply to the commercial general liability insurance described by subparagraphs ¶9.1A and ¶9.2B; (ii) such release shall apply to liability resulting from any risk insured against or covered by self-insurance maintained or provided by Tenant to satisfy the requirements of ¶9.1 to the extent permitted by this Lease; and (iii) Tenant shall not be released from any such liability to the extent any damages resulting from such injury or damage are not covered by the recovery obtained by Landlord from such insurance, but only if the insurance in question permits such partial release in connection with obtaining a waiver of subrogation from the insurer. This release shall be in effect only so long as the applicable insurance policy contains a clause to the effect that this release shall not affect the right of the insured to recover under such policy. Each party shall use reasonable efforts to cause each insurance policy obtained by it to provide that the insurer waives all

14

right of recovery by way of subrogation against the other party and its agents and employees in connection with any injury or damage covered by such policy. However, if any insurance policy cannot be obtained with such a waiver of subrogation, or if such waiver of subrogation is only available at additional cost and the party for whose benefit the waiver is to be obtained does not pay such additional cost, then the party obtaining such insurance shall notify the other party of that fact and thereupon shall be relieved of the obligation to obtain such waiver of subrogation rights from the insurer with respect to the particular insurance involved.

ARTICLE 10 LIMITATION ON LANDLORD’S LIABILITY AND INDEMNITY

10.1 Limitation on Landlord’s Liability: Landlord shall not be liable to Tenant, nor shall Tenant be entitled to terminate this Lease or to any abatement of rent (except as expressly provided otherwise herein), for any injury to Tenant or Tenant’s Agents, damage to the property of Tenant or Tenant’s Agents, or loss to Tenant’s business resulting from any cause, including without limitation any: (i) failure, interruption or installation of any HVAC or other utility system or service; (ii) failure to furnish or delay in furnishing any utilities or services when such failure or delay is caused by fire or other peril, the elements, labor disturbances of any character, or any other accidents or other conditions beyond the reasonable control of Landlord; (iii) limitation, curtailment, rationing or restriction on the use of water or electricity, gas or any other form of energy or any services or utility serving the Project; (iv) vandalism or forcible entry by unauthorized persons or the criminal act of any person; or (v) penetration of water into or onto any portion of the Premises or the Building through roof leaks or otherwise. Notwithstanding the foregoing but subject to ¶9.3, Landlord shall be liable for any such injury, damage or loss which is proximately caused by Landlord’s willful misconduct or active negligence.

10.2 Limitation on Tenant’s Recourse: If Landlord is a corporation, trust, partnership, joint venture, unincorporated association or other form of business entity: (i) the obligations of Landlord shall not constitute personal obligations of the officers, directors, trustees, partners, joint venturers, members, owners, stockholders, or other principals or representatives of such business entity; and (ii) Tenant shall not have recourse to the assets of such officers, directors, trustees, partners, joint venturers, members, owners, stockholders, principals or representatives except to the extent of their interest in the Project. Tenant shall have recourse only to the interest of Landlord in the Project for the satisfaction of the obligations of Landlord and shall not have recourse to any other assets of Landlord for the satisfaction of such obligations.

10.3 Indemnification of Landlord: Tenant shall hold harmless, indemnify and defend Landlord, and its employees, agents and contractors, with competent counsel reasonably satisfactory to Landlord (and Landlord agrees to accept counsel that any insurer requires be used), from all liability, penalties, losses, damages, costs, expenses, causes of action, claims and/or judgments arising by reason of any death, bodily injury, personal injury or property damage resulting from (i) any cause or causes whatsoever (other than the willful misconduct or active negligence of Landlord) occurring in or about or resulting from an occurrence in or about the Premises during the Lease Term, (ii) the negligence or willful misconduct of Tenant or its agents, employees and contractors, wherever the same may occur, or (iii) an Event of Tenant’s Default. The provisions of this ¶10.3 shall survive the expiration or sooner termination of this Lease and shall be subject to the release and waiver of subrogation provisions of section 9.3.

10.4 Indemnification of Tenant. Landlord shall hold harmless, indemnify and defend Tenant, from all liability, penalties, losses, damages, costs, expenses, causes of action, claims and/or judgments arising by reason of any death, bodily injury, personal injury or property damage resulting from the willful misconduct or active negligence of Landlord occurring in or about the Common Areas. The provisions of this ¶10.4 shall survive the expiration or sooner termination of this Lease. and shall be subject to the release and waiver of subrogation provisions of section 9.3.

ARTICLE 11 DAMAGE TO PREMISES

11.1 Landlord’s Duty to Restore: If the Premises are damaged by any peril after the Effective Date, Landlord shall restore the Premises unless the Lease is terminated by Landlord pursuant to ¶11.2 or by Tenant pursuant to ¶11.3. All insurance proceeds available from the fire and property damage insurance carried by

15