Sample Business Contracts

Revolving Note - Virtual Radiologic Corp. and Associated Bank NA

Sponsored Links

REVOLVING NOTE

|

$2,000,000.00 |

Minneapolis, Minnesota | |

| December 6, 2006 |

1. FOR VALUE RECEIVED, VIRTUAL RADIOLOGIC CORPORATION, a Delaware corporation (the "Borrower"), hereby promises to pay to the order of ASSOCIATED BANK, NATIONAL ASSOCIATION, a national banking association (the "Lender"), at its banking house located in Plymouth, Minnesota, the principal sum of Two Million and 00/100 Dollars ($2,000,000.00), or so much thereof as may be advanced by the Lender to or for the benefit of the Borrower pursuant to that certain Revolving Loan Agreement of even date herewith by and between the Borrower and the Lender (the "Loan Agreement"), and which remains unpaid, in lawful money of the United States and immediately available funds, together with interest on the outstanding balance accruing as of the date hereof at a rate equal to the Prime Rate of Interest (as hereinafter defined), as the same changes from time to time, with such rate to be adjusted on and effective as of the same day the Prime Rate of Interest changes. Notwithstanding the foregoing, under no circumstances will the interest rate on this Note be less than five percent (5.00%) per annum.

2. Accrued interest on this Note shall be due and payable monthly on the first (1st) day of each calendar month commencing on January 1, 2007, and continuing on the first (1st) day of each calendar month thereafter until this Note is paid in full. The full amount of principal plus accrued interest hereon shall be due and payable on the Revolving Line of Credit Expiration Date.

3. Interest hereunder shall be calculated on the basis of a year of three hundred sixty (360) days, but charged on the basis of the actual number of days principal is unpaid.

4. As used herein, the term "Prime Rate of Interest" shall mean the Lender's prime rate of interest (or equivalent successor rate) as a basis for determining the rate of interest on commercial borrowing, whether or not the Lender makes loans to other borrowers at, above or below said rate.

5. The outstanding principal balance of this Note may be prepaid in whole or in part at any time at the option of the Borrower without penalty or premium. For purposes of the foregoing, the term "prepayment" shall include any payment following acceleration of this Note. All prepayments shall be applied to amounts due hereunder in inverse order of maturity and shall not reduce the amount or change the due dates of the regular installments provided for above.

6. If any installment of principal or interest on this Note (including, without limitation, the installment due and payable on the Revolving Line of Credit Expiration Date is not paid within ten (10) days of the due date thereof, the Borrower shall pay to the Lender a late charge equal to five percent (5.00%) of the amount of such installment.

7. Notwithstanding anything to the contrary contained herein, at all times after an Event of Default has occurred and is continuing, interest shall accrue on amounts outstanding hereunder at a rate equal to five percent (5.00%) per annum in excess of the rate otherwise payable hereunder, as the same changes from time to time.

8. All payments and prepayments shall, at the option of the Lender, be applied first to any costs of collection, second to any late charges, third to accrued interest on this Note and the remainder thereof to principal.

9. Notwithstanding anything to the contrary contained herein, if the rate of interest, late payment fee or any other charges or fees due hereunder are determined by a court of competent jurisdiction to be usurious, then said interest rate, fees and/or charges shall be reduced to the maximum amount permissible under applicable Minnesota law.

10. This Note is issued pursuant to the terms and provisions of the Loan Agreement and is secured pursuant to the Security Agreement, and the Lender is entitled to all of the benefits provided for in said agreements.

11. Unless otherwise defined herein, all capitalized terms used herein shall have the meanings assigned to such terms in the Loan Agreement.

12. Upon the occurrence of an Event of Default and at any time thereafter, the outstanding principal balance hereof plus accrued interest hereon plus all other amounts due hereunder shall, at the option of the Lender, be immediately due and payable, without notice of demand.

13. Upon the occurrence of an Event of Default, and at any time thereafter, the Lender shall have the right to set off any and all amounts due hereunder by the Borrower to the Lender against any indebtedness or obligation of the Lender to the Borrower.

14. Upon the occurrence of an Event of Default and at any time thereafter, the Borrower promises to pay all costs of collection of this Note, including but not limited to attorneys' fees, paid or incurred by the Lender on account of such collection, whether or not suit is filed with respect thereto and whether or not such costs are paid or incurred, or to be paid or incurred, prior to or after the entry of judgment.

15. Demand, presentment, protest and notice of nonpayment and dishonor of this Note are hereby waived.

16. This Note shall be governed by and construed in accordance with the laws of the State of Minnesota without giving effect to the choice of law provisions thereof.

17. The Borrower hereby irrevocably submits to the jurisdiction of any Minnesota state court or federal court over any action or proceeding arising out of or relating to this Note, the Loan Agreement, the Security Agreement and any instrument, agreement or document related thereto, and the Borrower hereby irrevocably agrees that all claims in respect of such action or proceeding may be heard and determined in such Minnesota state or federal court. The Borrower hereby irrevocably waives, to the fullest extent it may effectively do so, the defense of an inconvenient forum to the maintenance of such action or proceeding in Minnesota. The Borrower irrevocably consents to the service of copies of the summons and complaint and any other process which may be served in any such action or proceeding by the mailing by United

- 2 -

States certified mail, return receipt requested, of copies of such process to the Borrower's last known address. The Borrower agrees that judgment final by appeal, or expiration of time to appeal without an appeal being taken, in any such action or proceeding shall be conclusive and may be enforced in any other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Paragraph shall affect the right of the Lender to serve legal process in any other manner permitted by law or affect the right of the Lender to bring any action or proceeding against the Borrower or its property in the courts of any other jurisdiction to the extent permitted by law.

| VIRTUAL RADIOLOGIC CORPORATION | ||

| By: |

Mark Marlow |

|

| Its: | CFO | |

|

STATE OF MINNESOTA |

) | |

| ) | ||

|

COUNTY OF HENNEPIN |

) |

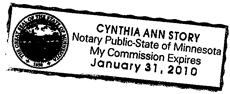

The foregoing instrument was acknowledged before me this 6th day of December, 2006, by Mark Marlow, the CFO of Virtual Radiologic Corporation, a Delaware corporation, for and on behalf of the corporation.

Cynthia Ann Story

Cynthia Ann Story

12𤖬006

- 3 -